us exit tax form

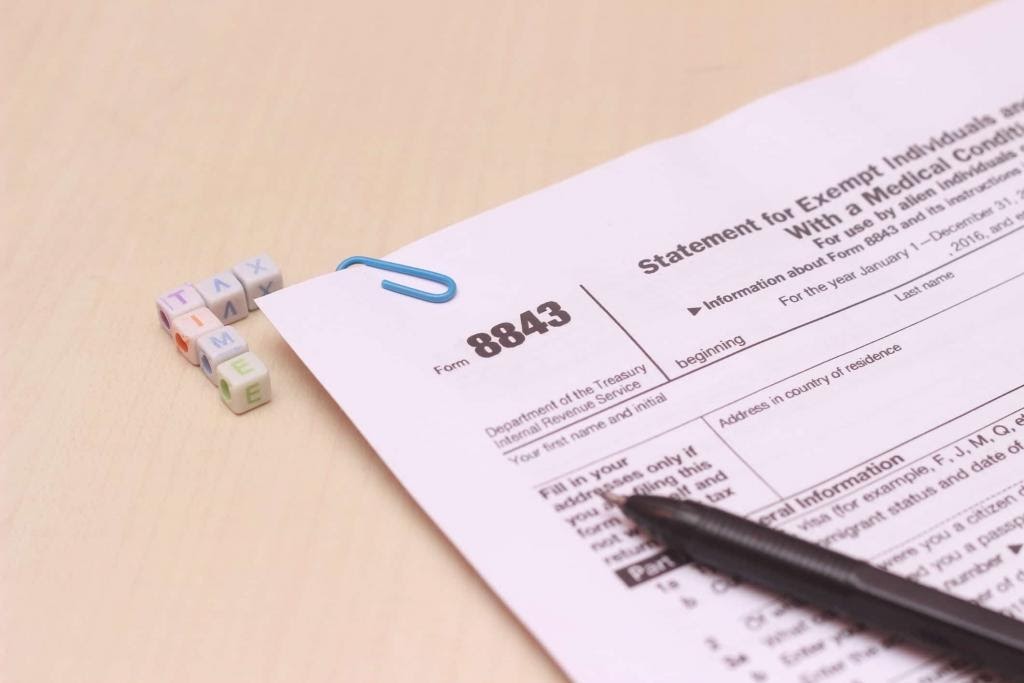

For calendar year 2021 or other tax year beginning 2021 and ending. Citizen who relinquishes his or her citizenship and 2 any long - term resident of the United States who ceases to be a lawful.

1040 Vs 1040nr Vs 1040nr Ez Which Form To File 2022

The decision to become a US tax resident or to leave the US tax system is not one that should be taken lightly.

. Initial and Annual Expatriation Statement. Currently net capital gains can be taxed as high as. The defining feature is that assets are treated as if they are sold on the day before.

Citizenship or terminated their long-term resident status for tax purposes. Yes even if you are not a covered expatriate under the Exit Tax tests and dont owe any Exit Tax you must file Form 8854. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain.

Net worth one common way that people get hit with the green card exit tax is by having a net worth exceeding 2 million at the time that you lose your status. The term expatriate means 1 any US. 2 IRC 877 Expatriation to Avoid Tax.

The IRS Green Card Exit Tax 8 Years rules involving US. Legal Permanent Residents is complex. Citizens and long-term residents must carefully plan for any proposed expatriation from the US.

Green Card Exit Tax 8 Years. The exit tax rules impose an income tax on someone who has made his or her exit from the US. Presuming the person who expatriates qualifies as a.

US Exit Tax IRS Requirements. Is there an exit tax in the US. To comply with the notification obligations under IRC 877 individuals who renounced their US.

Anytime a US citizen or long-term permanent resident chooses to. The Form 8854 is required for US citizens as part of the filings to end. Any appreciation in excess of 690000 as of 2015 will be subject to the exit tax.

The tax calculation must be provided on Form 8854. Green Card Exit Tax 8 Years Tax Implications at Surrender. Generally if you have a net worth in excess of 2 million.

The idea of the exit tax is the concept that if a US person falls into one of the two categories of being a Long-Term Resident or US Citizen and 1 they have assets that have accrued in value. Put simply exit tax is an income tax. In order to be considered a US expatriate you have to voluntarily renounce your Green Card using form I407 and stating that you no longer wish to live in the United States.

GSA-FAR 48 CFR 53229. 3 IRC 877A Tax Responsibilities at Expatriation US Exit Tax 4 Form 8854 Initial and Annual Expatriation. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria.

SF1094 United States Tax Exemption Form. Citizenship or long-term residency triggers both the exit tax and the. In 2015 you are now provided an option.

Assets held by an expatriate or green card holder will be treated as though they were sold the day before the individual renounced his or her citizenship. 1 US Exit Tax. Form 8854 2021 Department of the Treasury Internal Revenue Service.

The most important aspect of determining a potential exit tax if the person is a covered expatriate.

/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

Form 1099 Int Interest Income Definition

What Is Expatriation Definition Tax Implications Of Expatriation

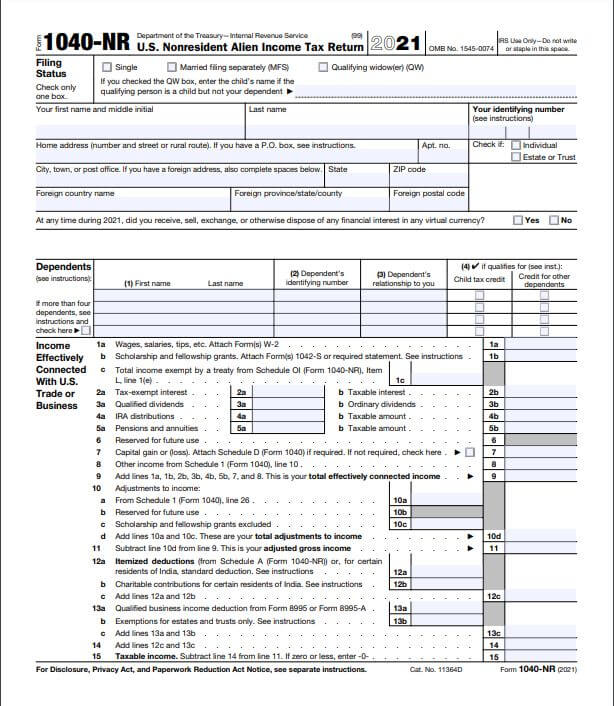

Instructions For Form 1040 Nr 2021 Internal Revenue Service

A Dive Into The New Form 5471 Categories Of Filers And The Schedule R Sf Tax Counsel

1040 Vs 1040nr Vs 1040nr Ez Which Form To File 2022

What Is Expatriation Definition Tax Implications Of Expatriation

Exit Tax In The Us Everything You Need To Know If You Re Moving

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Expat Tax Services Expatriate Tax Protax

Covered Non Covered Expatriate H R Block

Us Resident For Tax Purposes Faq Page 1040 Abroad

1040 Vs 1040nr Vs 1040nr Ez Which Form To File 2022

Exit Tax In The Us Everything You Need To Know If You Re Moving

Instructions For Form 1040 Nr 2021 Internal Revenue Service