franklin county ohio sales tax rate 2020

Ad Find Out Sales Tax Rates For Free. DEPARTMENT OF TAXATION.

Ohio Sales Tax Guide And Calculator 2022 Taxjar

The December 2020 total local sales tax rate was also 7500.

. The current total local sales tax rate in Franklin County OH is 7500. Ad Integrates Directly w Industry-Leading ERPs. Reduce audit risk as your business gets more complex.

The Franklin County Sales Tax is 125. Geographic Information System Auditor. What is Ohio sales tax rate 2020.

You can print a 7 sales tax. Fast Easy Tax Solutions. Fast Easy Tax Solutions.

2nd Quarter effective April 1 2020 - June 30 2020 Rates listed by county and transit authority. How much is sales. The minimum combined 2022 sales tax rate for Franklin County Ohio is.

Franklin OH Sales Tax Rate The current total local sales tax rate in Franklin OH is 7000. Adult Protective Services Office on. Some cities and local.

Adoptable Dogs Animal Control. The December 2020 total local sales tax rate was also 7000. Ad Find Out Sales Tax Rates For Free.

The minimum combined 2022 sales tax rate for Franklin Ohio is. PAGE 1 REVISED October 1 2020. The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax.

What is the sales tax rate in Franklin County. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange. The state sales tax rate in Ohio is 5750.

The following list of Ohio post offices shows the. The December 2020 total local sales tax rate was also 7500. COLUMBUS OH 43216-0530.

Sales tax in Franklin County Ohio is currently 75. The County sales tax. With local taxes the total sales tax rate is between 6500 and 8000.

This is the total of state and county sales tax rates. STATE OF OHIO. The sales tax rate for Franklin County was updated for the 2020 tax year this is the current sales tax rate we are using in the.

Reduce audit risk as your business gets more complex. Ad Integrates Directly w Industry-Leading ERPs. A county-wide sales tax rate of 125 is applicable to localities in Franklin County in addition to the 575 Ohio sales tax.

The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax. Marriage Licenses Probate Court. There were no sales and use tax county rate changes effective July 1 2020.

The Ohio sales tax rate is currently. The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales tax and 175 Franklin County local sales taxesThe local sales tax consists of a 125 county sales. This is the total of state county and city sales tax rates.

There is no applicable city tax or special tax.

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Ohio Sales Tax Rates By City County 2022

Ohio Tax Rates Things To Know Credit Karma

Washington Sales Tax Guide For Businesses

How To Reduce Virginia Income Tax

Ohio Sales Tax Small Business Guide Truic

Montgomery County Md Property Tax Calculator Smartasset

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Ohio Tax Rates Rankings Ohio State Taxes Tax Foundation

Kansas Sales Tax Rates By City County 2022

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Ebay Sales Tax Everything You Need To Know Guide A2x For Amazon And Shopify Accounting Automated And Reconciled

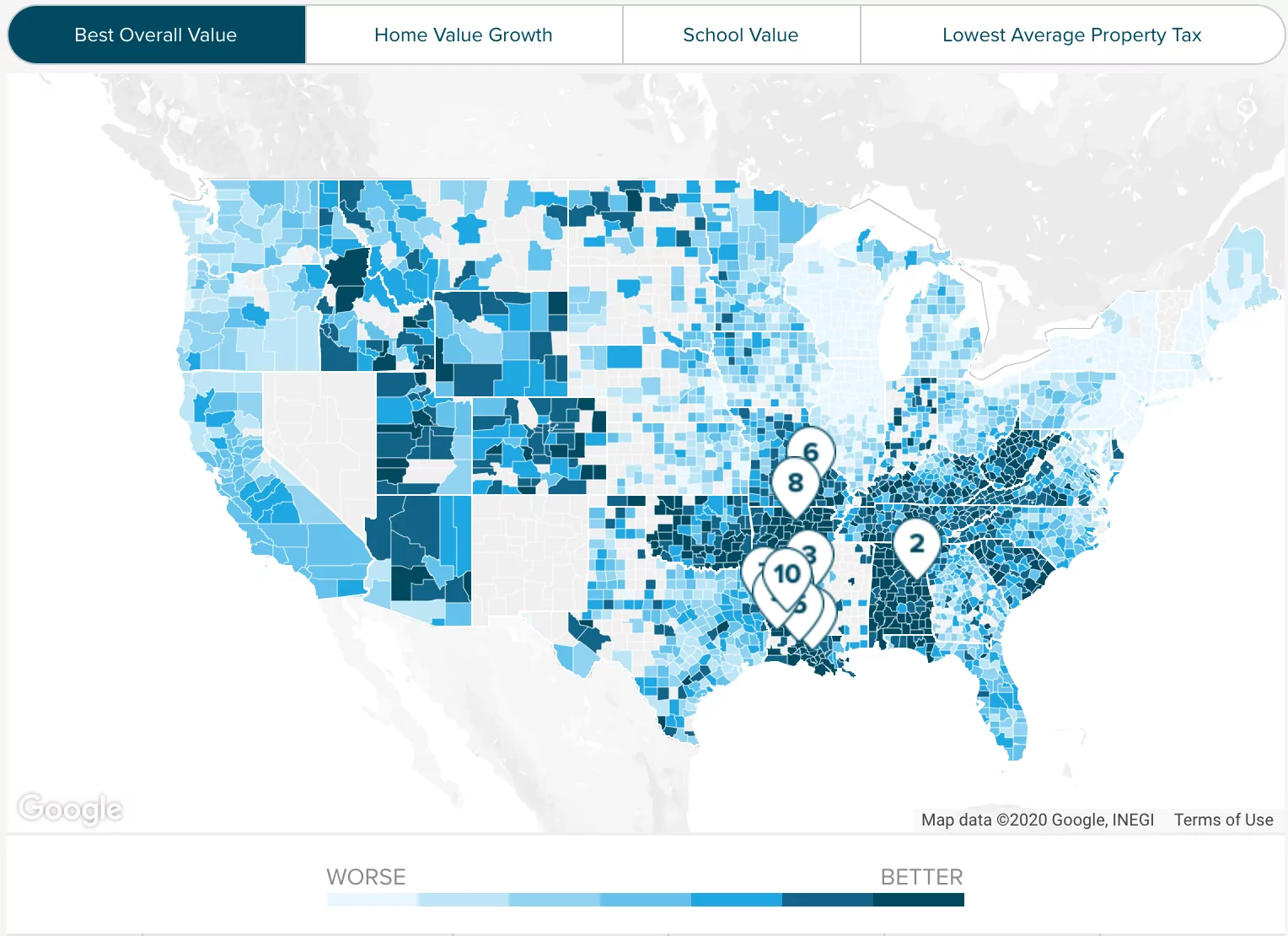

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Ohio Tax Rates Rankings Ohio State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

File Sales Tax By County Webp Wikimedia Commons

Florida Sales Tax Rates By City County 2022

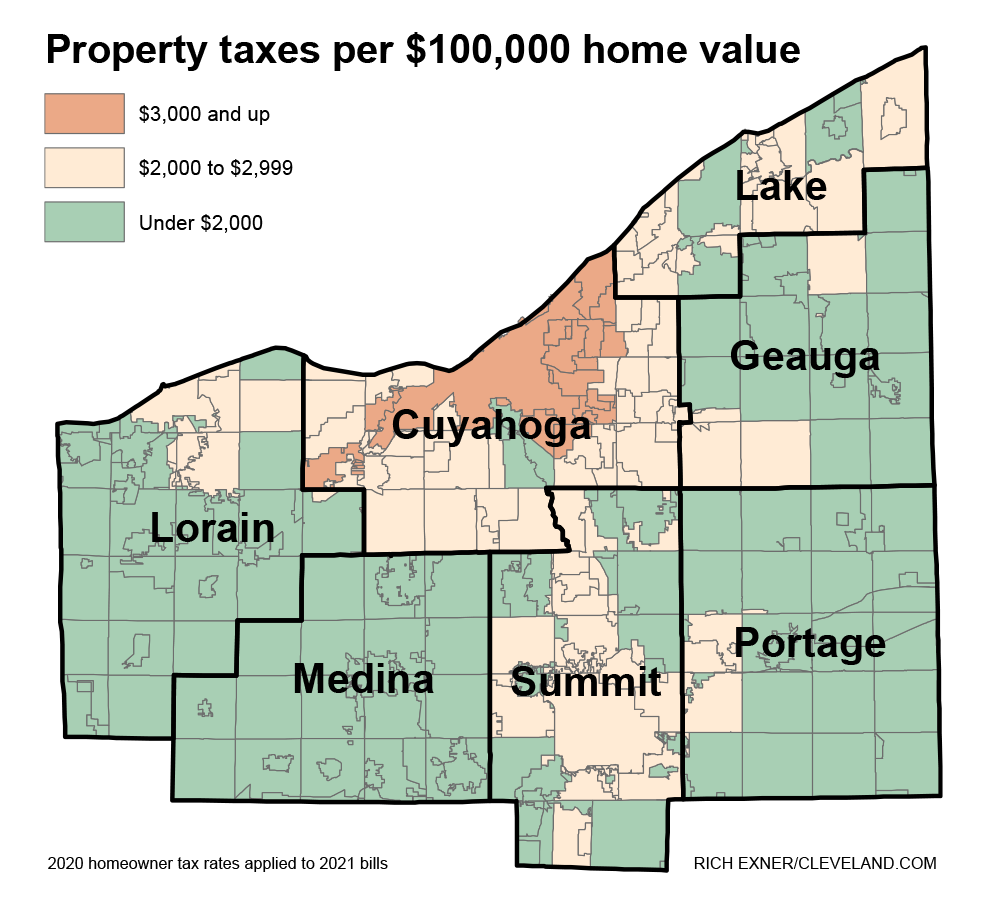

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com