tax benefit rule definition and examples

Tax benefits include tax credits tax deductions and tax deferrals. The tax benefit rule requires Company XYZ to report the 100000 as income on its 2010 tax return and pay taxes on it.

What Are Pre Tax Deductions Bamboohr Glossary

Whats the definition of Tax benefit rule in thesaurus.

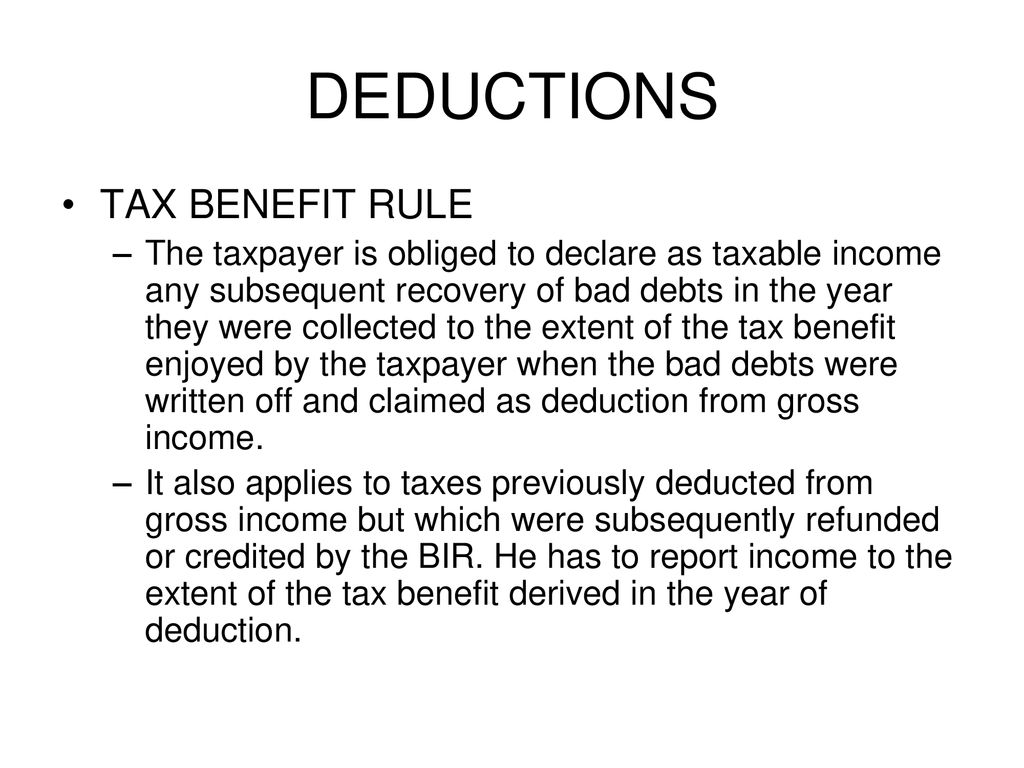

. A tax provision that says. The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a subsequent. The benefits received rule is a tax system wherein the amount an individual or business pays is based on how much they benefit from something public.

The tax benefit rule states that if a deduction is taken in a prior year and the. Your tax benefit is the difference between the 12600 deduction you would have claimed without the state tax deduction versus the 13000 you actually claimed. The tax benefit rule is.

A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross. The tax benefit rule means that if a taxpayer receives a tax benefit from an item in a prior year because of a deduction and then recovers the money in a subsequent year the. The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the underlying amount must be.

A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the. Thesaurus for Tax benefit rule. A theory of income tax fairness that says people should pay taxes based on the benefits they receive from the government.

Why Does a Tax Benefit Matter. Meaning pronunciation translations and examples. A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit.

When their 2018 state income tax return was prepared the couple received a. Tax benefit rule definition based on common meanings and most popular ways to define words related to tax benefit rule. Joe and Denise Smith itemize deductions on.

A tax benefit is any tax advantage given by the IRS to a taxpayer that reduces his or her tax burden. Legal Definition of tax benefit rule. Example of the Tax Benefit Rule.

A tax benefit is an allowable deduction on a tax return intended to reduce a taxpayers burden while typically supporting certain types of commercial activity. Learn how it works and its rules benefits limitations and more. The tax benefit rule means that if a taxpayer receives a tax benefit from an item in a prior year because of a deduction and then recovers the money in a subsequent year the.

Most related wordsphrases with sentence examples define Tax benefit rule meaning and usage. Benefits Received Rule. Tax-loss harvesting works by selling shares for a loss to offset gains to lower capital gains tax owed.

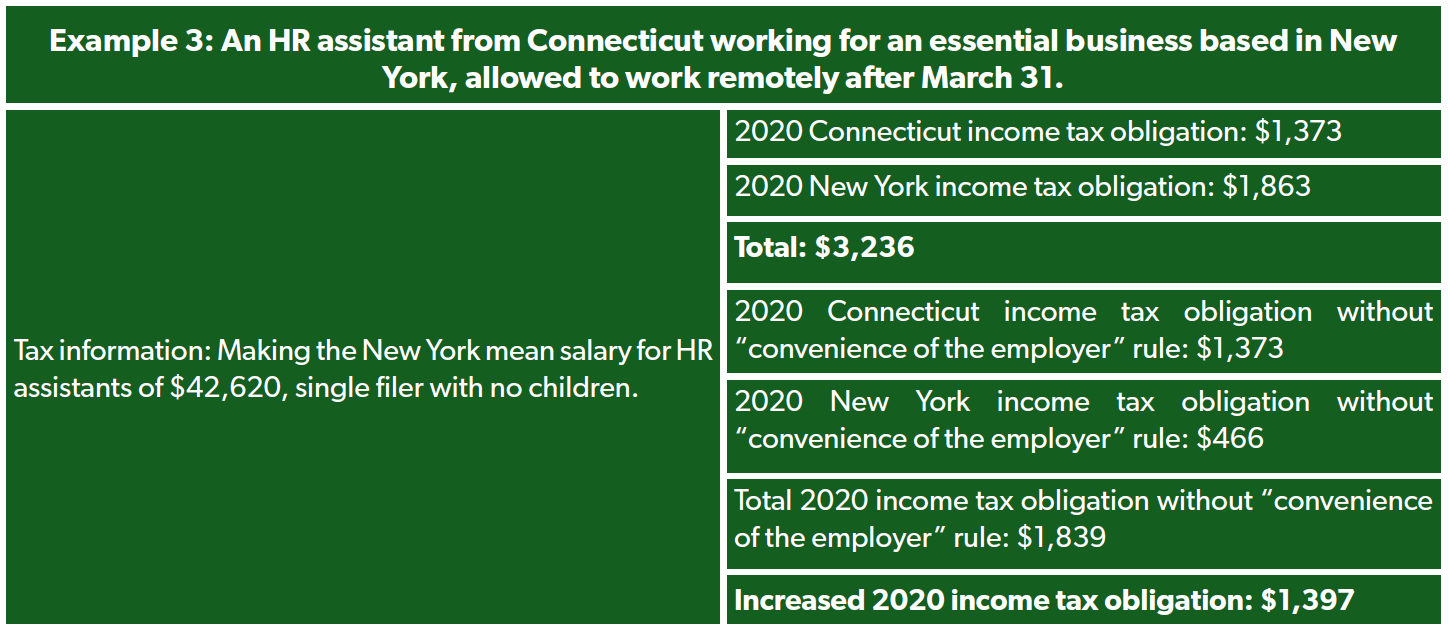

New York S Aggressive Pandemic Tax Strategy Underscores Need For Congressional Action Foundation National Taxpayers Union

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Tax Benefit Meaning Examples How Tax Benefit Works

Income Tax Deductions Exemptions Under Sections 80c 80d 80ddb

How Does The Deduction For State And Local Taxes Work Tax Policy Center

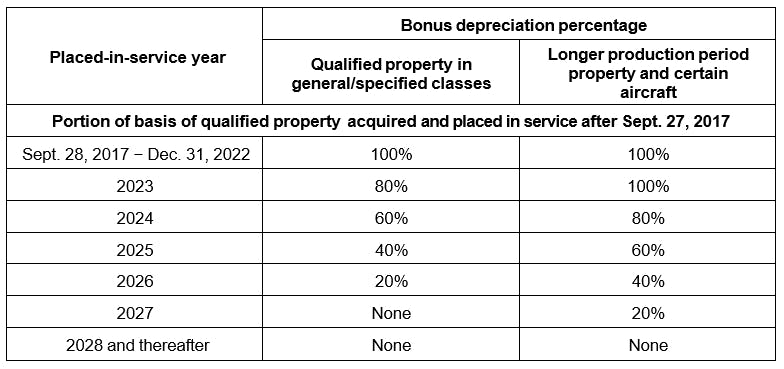

Bonus Depreciation Rules Recovery Periods For Real Property And Expanded Section 179 Expensing Baker Tilly

The Qbi Deduction Do You Qualify And Should You Take It Bench Accounting

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca

What Are Pre Tax Deductions Definition List Example

Wash Sale Rule What It Is And How To Avoid The Motley Fool

10 Tax Benefits Of Owning A Home Forbes Advisor

Wash Sale Rule What Is It Examples And Penalties

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Benefits Of Donating Publicly Traded Securities To Charity Schwab Charitable Donor Advised Fund Schwab Charitable

Tax Deduction Definition Taxedu Tax Foundation

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

/dotdash_Final_Net_of_Tax_Dec_2020-98efd407350341fdb178949dadd84c5c.jpg)

/dotdash_Final_Net_of_Tax_Dec_2020-98efd407350341fdb178949dadd84c5c.jpg)